The Walt Disney Company: A Comprehensive Investment Analysis

Assessing the Magic Kingdom's Financial Strength and Investment Potential

Welcome to our in-depth investment analysis of The Walt Disney Company, a global leader in the entertainment industry. This comprehensive exploration will offer a detailed examination of Disney's diverse business segments, its strategic entry into the streaming market with Disney+, and the enduring appeal that defines its brand. We aim to provide an all-encompassing review of the company's financial performance, competitive positioning, and future prospects, going beyond the enchantment of its storytelling to dissect its economic viability. This analysis is designed for seasoned professionals and investors who seek a meticulous and robust understanding of Disney's financial dynamics. By determining its true valuation, we aim to assess whether the company can maintain its industry dominance and deliver long-term, sustainable returns to its shareholders. Join us as we delve into the intricate financial narrative of this entertainment powerhouse. Let's uncover the investment potential behind the magic.

Dissecting Disney: A Comprehensive Breakdown of Revenue Streams

Decoding the Business Model of The Walt Disney Company

Our analysis begins with The Walt Disney Company, an archetype of a diversified multinational mass media and entertainment conglomerate. While Disney operates in a multitude of sectors, it is primarily classified under the "Consumer Discretionary" sector in the stock market, listed as DIS on the NYSE. This classification is due to the nature of its business offerings such as theme parks, movies, and consumer products, which are considered non-essential goods and services that consumers may limit or avoid during economic downturns. Understanding this is fundamental as we delve deeper into Disney's complex business model and varied revenue streams.

Disney's operation encompasses four main segments: Media Networks, Parks, Experiences and Products, Studio Entertainment, and Direct-to-Consumer & International. The Media Networks segment includes cable and broadcast television networks, television production operations, television distribution, domestic television stations, and radio networks. The Parks, Experiences, and Products segment is made up of the company's theme parks, resorts, cruise lines, vacation clubs, and consumer products operations. The Studio Entertainment segment covers the company's motion picture and music production, and theatrical operations. Finally, the Direct-to-Consumer & International segment comprises the company's streaming services such as Disney+, ESPN+, and Hulu, along with the company's international television networks and channels.

A substantial portion of Disney's revenue, amounting to a remarkable 67%, originates from its media and entertainment distribution, which includes TV networks and streaming services like ABC, ESPN, Disney+, and Hulu. The remaining income is sourced from its Parks, Experiences, and Products division. Disney's portfolio has also seen significant expansion through strategic acquisitions of major properties such as Pixar, Marvel, LucasFilms, and Twenty-First Century Fox

Magic of Marvel and Power of Pixar: Acquisitions Fuelling Disney's Growth

Assessing the Strategic Influence of Key Acquisitions on Disney's Financial Performance

A key strategy in Disney's growth playbook has been its shrewd and strategic acquisitions. The most notable of these have been Pixar Animation Studios, Marvel Entertainment, Lucasfilm, and Twenty-First Century Fox. Each of these acquisitions was masterfully executed and integrated, enhancing Disney's intellectual property portfolio and paving the way for blockbuster content and lucrative franchise opportunities.

Pixar 🎥: This powerhouse of animation was acquired by Disney in 2006. The $7.4 billion acquisition bolstered Disney's animation studio with a new innovative spirit, leading to a string of successful films such as "Up," "Wall-E," and "Inside Out."

Marvel 🦸♀️🦸: Disney's 2009 acquisition of Marvel Entertainment for approximately $4 billion allowed Disney to tap into Marvel's vast universe of more than 5,000 characters. This move led to the creation of the phenomenally successful Marvel Cinematic Universe, home to blockbusters like "The Avengers" series and "Black Panther."

Lucasfilm 🚀: In 2012, Disney acquired Lucasfilm, the production company behind the iconic Star Wars and Indiana Jones franchises, for around $4.05 billion. This added another lucrative franchise to Disney's portfolio, leading to new Star Wars sequels and spin-offs.

Twenty-First Century Fox: The most recent and largest acquisition, valued at $71.3 billion in 2019, brought a treasure trove of content into Disney's library. It bolstered Disney's content offering for its then-newly launched streaming service, Disney+.

The acquisitions have driven Disney's growth, shaped the company's direction, and transformed its content creation capabilities. In the next section, we will explore how these acquisitions have been integrated into Disney's business model and their impact on the company's financial performance.

From Big Screen to Small Screen: The Rise of Disney+

Assessing the Impact of Disney's Foray into the Streaming Market on its Financial Health

The launch of Disney's own streaming service, Disney+, in November 2019 marked a significant milestone in the company's history. With a unique blend of content from Disney, Pixar, Marvel, Star Wars, and National Geographic, Disney+ arrived on the streaming scene with an impressive library. The service has grown rapidly, reaching over 100 million subscribers globally within just 16 months of its launch.

Disney's transition into streaming was a strategic move to adapt to the changing landscape of content consumption. As consumers increasingly favored streaming services over traditional cable TV, Disney+ offered a new revenue stream and an opportunity to engage directly with consumers. The direct-to-consumer approach also allowed for valuable data collection, enabling more personalized content and marketing strategies.

Disney+'s early success is a testament to Disney's brand strength and its vast content library. Moreover, the pandemic-induced lockdowns accelerated the growth of streaming services, and Disney+ was no exception. However, the development and maintenance of a streaming platform come with significant costs, and these expenses have impacted Disney's financials. In the next section, we will delve into Disney's financial performance, scrutinizing how the costs of Disney+ have influenced the company's bottom line and assessing the platform's long-term profitability potential.

Navigating the Strategic Landscape: Disney's Transactions Over the Past Two Years

From Acquisitions to Divestitures: Unraveling Disney's Business Moves

Over the past couple of years, The Walt Disney Company has been steering its ship through the vast seas of the media and entertainment industry, setting its course by the compass of strategic transactions. These maneuvers, involving a range of acquisitions and divestitures, have both shaped and been shaped by Disney's evolving strategic vision. Let's embark on a journey through the recent business ventures of this media giant to better understand the strategic moves shaping its future.

In a significant move to enhance its streaming capabilities, Disney acquired BAMTech LLC, a firm specializing in direct-to-consumer streaming technology, marketing services, data analytics, and commerce management. This acquisition dovetails perfectly with Disney's ongoing endeavor to expand its digital footprint.

However, not all ventures were about acquisitions. Disney navigated the waters of divestiture by selling a majority stake in the ESPN X-Games, a semi-annual extreme sports event, to MSP Sports Capital. This was followed by the sale of 3 Fox Sports Channels in Argentina to Imagina Media Audiovisual SL, another move in the divestiture strategy.

Disney's broadcasting assets also saw a transformation, with transactions involving Wfxt, a television station, and the sale of KESN-FM, a sports talk radio station, to VCY America, Inc. In a similar vein, Disney divested four of its stations to Good Karma Broadcasting LLC.

Other notable transactions include the sale of a majority stake in FoxTelecolombia SAS, a television production company, to ViacomCBS, Inc., and the divestiture of Fox Sports Mexico Distribution LLC to Grupo Multimedia Lauman SAPI de CV. Disney also divested its stake in Eredivisie Media & Marketing CV, a media company holding the media and sponsorship rights of the Dutch Premier League, to Eredivisie CV. In another strategic move, Disney sold TrueX, Inc., an engagement advertising platform, to PaeDae, Inc.

These transactions collectively narrate a story of strategic realignment, as Disney seems to be navigating towards streamlining its operations, fortifying its core businesses, and divesting non-core assets.

Key Financial Metrics: A Deep Dive into Disney's Performance

Unveiling the Magic Kingdom's Financial Fortitude: Past, Present, and Future

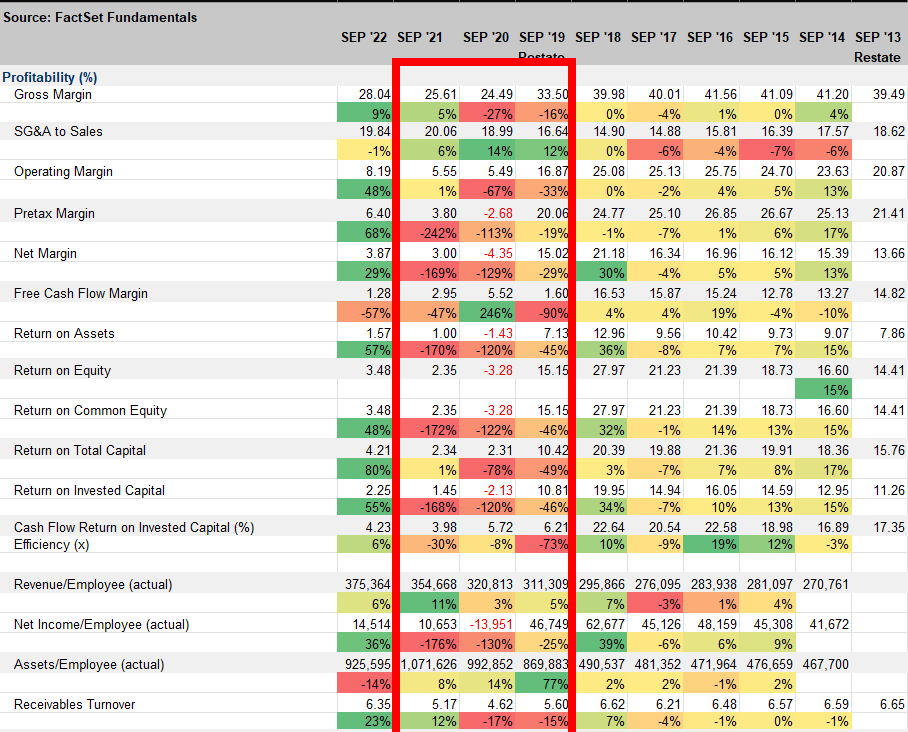

Embarking on our in-depth exploration of Disney's financial health, we find a landscape filled with both potential treasures and possible pitfalls. Over the past few years, this leading multinational entertainment and media enterprise has presented a mixed financial performance, as revealed by several crucial metrics. The company's financial journey, much like the narratives of its beloved stories, is a blend of challenges and opportunities.

Notably, this varied performance has been heavily influenced by a series of major external events. The global pandemic and its resultant restrictions severely impacted Disney's Parks and Recreations segment. Simultaneously, the company was navigating the acquisitions and adaptations related to the acquisition of Twenty-First Century Fox (TFCF). Another significant development was the launch of Disney+, which marked the company's foray into the competitive streaming service industry. These three pivotal events—occurring in quick succession in 2019, 2020, and 2021—have left indelible imprints on Disney's financial narrative.

In particular, the impact of COVID-19 and the subsequent measures to contain its spread introduced unforeseen challenges for Disney. Yet, despite these hurdles, the company demonstrated agility and resilience, adapting to the changing environment and charting a course through turbulent waters. As we continue our exploration, we bear witness to Disney's capacity to navigate these challenges and seize the opportunities they present.

Disney's stock price, much like a turbulent sea voyage, has experienced its fair share of fluctuations. The five-year average change stands at a mere 0.1%, with Disney underperforming the S&P 500 and its industry on average over this time. To add to the complexity of the story, the company has not paid a dividend since 2020, leading to a dividend yield of 0.0%.

This tale is further complicated by the fact that we believe the stock price has been profoundly impacted by the various challenges we've previously highlighted. Additionally, the suspension of dividends might initially be perceived as a negative development by some investors. However, we view this as a strategic reinvestment into the company's shifting focus toward streaming and software services.

These transformative endeavors demand significant capital, and redirecting dividends into these growth areas demonstrates Disney's commitment to adapting and thriving in the evolving media landscape. Moreover, as the company solidifies its presence in the streaming arena and reaps the benefits of its investments, we anticipate a gradual resumption of dividends. The return to previous dividend yield levels is likely to be a slow but steady journey, much like the plot development of a gripping Disney saga.

However, not all is bleak in the kingdom. Sales have shown a consistent growth story, boasting a compound annual growth rate (CAGR) of 8.5% over the five-year period. Contrastingly, EBITDA, net income, and diluted earnings per share (EPS) have witnessed declines, shedding light on the multi-faceted nature of the company's financial narrative.

The narrative further unfolds with an increase in the number of diluted shares outstanding, a move largely attributed to Disney's acquisition of 21st Century Fox, where the stock payment was involved. This strategic decision, while diluting shares, was aimed at bolstering Disney's content library and strengthening its position in the competitive entertainment landscape. Simultaneously, we witness a rise in the book value per share, showcasing the company's growing intrinsic value.

Adding to the intrigue is the growth in cash & short-term investments and total assets, a testament to Disney's robust financial management and its ability to generate substantial cash flows from its diverse business operations. Yet, the story wouldn't be complete without acknowledging the growth of long-term debt. This development, while indicative of the company's aggressive investment in strategic initiatives, serves as a reminder of the potential risks lurking in the shadows.

This careful balance of expansion and risk management highlights Disney's strategic prowess and underlines its resilience in navigating the complex entertainment industry. As we continue to turn the pages of Disney's financial story, we find a tale of calculated decisions, strategic investments, and financial discipline. Through it all, Disney remains a compelling character on the global business stage, captivating the hearts of investors and consumers alike.

Delving into Disney's treasure chest, we find that the net operating cash flow and free cash flow have declined over the five-year period. This trend raises eyebrows and calls for further investigation. Yet, as we chart the course of the company's profitability, a different tale emerges. Key indicators such as gross margin, EBITDA margin, EBIT margin, and net margin, alongside return on assets (ROA) and return on equity (ROE), have maintained average levels.

Remarkably, Disney's ability to sustain these average levels—even in light of the past three extraordinary years marked by unpredictable and challenging circumstances—paints an encouraging picture. This resilience, the ability to weather hard and uncontrollable times, further bolsters the company's prospects. As we continue to assess Disney's financial performance, we appreciate the strength of a company that navigates stormy seas, steadfastly holding its course, and offering a beacon of stability amidst uncertainty. This resilience is a testament to Disney's robust business model and strategic acumen, enhancing its appeal to investors keen on long-term value.

In Disney's kingdom, we encounter a moderate level of leverage. However, an unexpected twist appears in our narrative with a decrease in the total number of subscribers for its streaming services from September 2022 to March 2023.

Yet, this plot twist might not be as ominous as it first appears. In a fortuitous turn of events, we witness the return of a previous manager—a seasoned navigator who has demonstrated remarkable success in adapting to new environments. This development casts a reassuring light on the decline in subscribers, especially when we consider that this is the first dip since the streaming service's inception.

The reappointment of this proven leader (Iger) signals a proactive response to the challenges at hand. Given their track record of successful adaptation, there is less reason to worry about the subscriber downturn. As we continue our exploration of Disney's realm, this aspect further underscores the company's strategic resilience and adaptability. It's a testament to their commitment to innovation and reinvention in the face of changing tides.

Quick Recap

Despite its stock's recent rise, Disney has underperformed when compared to its streaming competitors like Netflix and Apple in the long term. Disney's stock has fallen by 5% since 2018, primarily due to the impacts of the COVID-19 pandemic in 2020 and 2021, along with the substantial costs incurred in the highly competitive streaming industry And adaptations of it acquisitions (TCF)

Despite the challenges, Disney's strength in its extensive library of popular media franchises allowed it to surpass Netflix in terms of subscribers and market share in 2022. This suggests that it could be a viable long-term investment

As for the financial performance, Disney's annual revenue for 2022 was $82.722 billion, marking a 22.7% increase from 2021. This represents a significant recovery from a 6.06% decline it experienced from 2019 to 2020 due to the pandemic

Disney's net income also saw substantial growth in 2022, with the annual net income reaching $3.145 billion, a 57.64% increase from 2021. This marks a significant rebound from the net loss of $2.864 billion reported in 2020

However, Disney's total debt also increased in 2022, reaching $65.079 billion, a 3.21% rise from 2021. (Investing in adaptation)

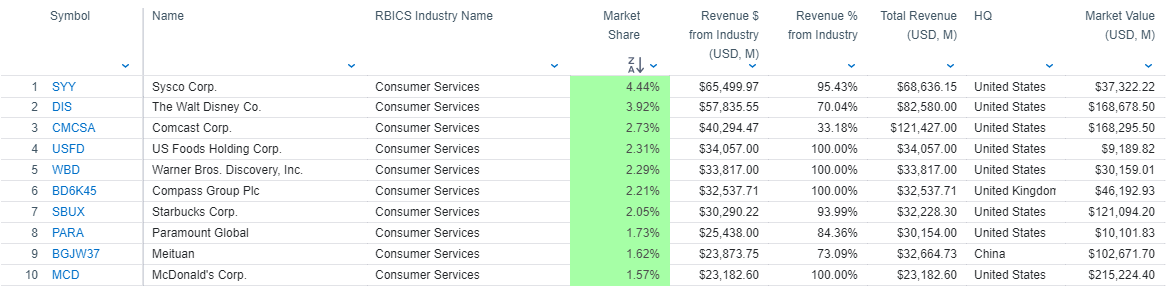

Market share

A confluence of factors—the global COVID-19 pandemic, temporary park closures, and a shifting media landscape—created a challenging environment. Disney faced headwinds as the world anxiously observed the unfolding crisis. Yet, despite these challenges, Disney adapted quickly, accelerating its direct-to-consumer strategy with the successful launch of Disney+. During this tumultuous period, a significant number of investors, institutions, and mutual funds increased their stakes in Disney over the last six months, demonstrating their belief in Disney's resilient business model and strategic adaptability.

Indeed, despite the financial fluctuations and evolving business focus, Disney has proven its resilience by retaining a strong foothold in its competitive segments. As the story unfolds, we observe that Disney remains a dominant player in almost every market it competes in.

From its timeless animated features to its blockbuster Marvel and Star Wars franchises, its world-renowned theme parks to its rapidly growing streaming platform, Disney continues to lead and innovate. The company's ability to maintain leadership across such diverse segments demonstrates its adaptability, creativity, and enduring appeal.

This impressive performance underscores Disney's strategic competence and the strength of its brand, which are crucial components of its long-term growth story. As the company continues to adapt and evolve, its leadership in multiple segments bodes well for its future prospects.

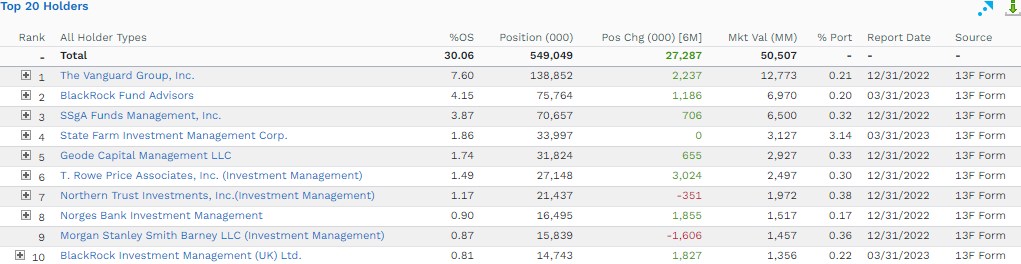

Disney investors

This upswing in investor confidence offers a tangible indicator of the faith these entities have in the future prosperity of Disney. It's worth noting that these investors have access to a plethora of resources and research to inform their decisions, suggesting their increasing investments in Disney are not arbitrary but rather a result of comprehensive analysis and a positive outlook for the company's future performance.

The continued commitment and increasing investment from these significant stakeholders speak volumes about the perceived value and potential return of Disney's stock, providing another layer of intrigue to the investment story of this entertainment behemoth.

VALUATION

In the search for the intrinsic value of Disney's stock, it's critical to consider a variety of valuation methods. While none of these models serve as a holy grail, they collectively provide a comprehensive toolkit that can inform investment decisions. For this analysis, I used the last paid dividends to weigh pre-COVID years more than the post-pandemic period. Despite my expectation that dividend yield will eventually return to pre-2019 levels, I chose to base calculations on the most recent figures. This approach extends to all aspects of the valuation analysis.

For the CAPM calculation, I averaged several betas to find a middle ground, ultimately settling on 1.00, which represents a market risk similar to the broader market. However, it could be slightly higher, perhaps around 1.05. The chosen growth rate (Gs) of 10.4% and the long-term growth rate (Glong) of 5.00% reflect Disney's transition towards high-growth segments like streaming. The horizon price for the stock is based on the average of future forecasted prices for the next three to five years.

Here's a look at the raw data:

Most valuations, with the exception of the EPS P/E benchmark, are significantly above the current stock price. The high values offered by these models suggest a potential undervaluation of Disney's shares. It's important to remember that while these models are valuable tools, they are not definitive. They should be used in conjunction with a comprehensive business analysis to determine whether an investment is likely to be profitable.

Finally, the FCFE0 value (Free Cash Flow to Equity at time 0) used in the analysis is 2.728156568, and the share price at time 5 (T5) is expected to be $165. The chosen values of H and N in the models reflect Disney's strategic shift to higher growth segments and long-term growth prospects.

CONCLUSION:

In conclusion, Disney presents a compelling case as a mid to long-term investment. This is not to say that the stock price may not dip further from its current point, but the potential for upward price movement coupled with a prospective return of dividends makes Disney an enticing prospect for investors who adopt a holding strategy.

Our conviction stems from a thorough understanding of Disney's recent history. The decline in the stock price can largely be attributed to growth investment strategies, specifically the acquisition of TCF in 2019, which increased share dilution and overall costs for the company. In addition, the extraordinary circumstances posed by the COVID-19 pandemic had a significant impact on the business.

However, taking these unique factors into consideration, the path forward for Disney looks promising. The return of proven leader Bob Iger to the helm is a positive development, and the company's dominance in almost every segment in which it competes is a testament to its enduring strength. The strategic shift towards high-growth segments such as software and streaming services reflects Disney's adaptability and forward-thinking approach.

Most importantly, our valuation analysis reveals a significant gap between Disney's current stock price and its intrinsic value. This gap offers a substantial margin of safety, further enhancing the appeal of Disney as an investment.

In essence, the unique blend of Disney's strong market position, strategic growth focus, experienced leadership, and intrinsic value relative to its current price positions the company as an attractive prospect for mid to long-term investors. We believe that Disney is well-equipped to navigate the challenges ahead and deliver solid returns over time.